Well, we fell off the bandwagon.

We didn’t make much progress this month due to a few factors:

- A trip to The Wizarding World of Harry Potter in Orlando, FL (Great trip, huge nerds)

- Booking hotels for friends weddings on Priceline ($600)

- Car Insurance for the next 6 months ($750)

- Excessive Food & Dining Spending due to travel/weekend activities

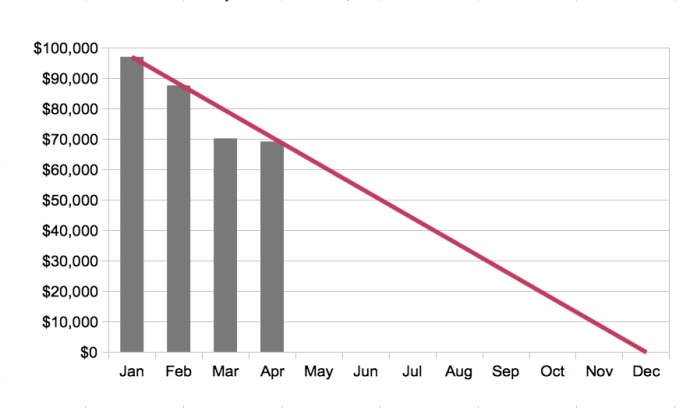

Oops. It’s just a major bummer since last month we were *ahead* of our goals. Now, we put ourselves in a situation where we need to payoff nearly $9000 in debt next month to stay on track – yikes!

My New Years Resolution – No Travel

The biggest obstacle to our debt payoff goal this month was travel. We always try to save money when we travel. We use miles and points for 90% of our flights and hotels. We use coupon codes, Priceline, and shop around for discounts when we can’t use points. For our latest trip to Universal Studios, we even received discounted tickets to the park since we were going with our friend who is an NBC employee. Despite all of our attempts to save money on travel, we still ended up spending major moolah due to eating out and other costs.

In 2012, I received the Southwest Companion Pass which allowed Mr. Debt Albatross to travel with me on any Southwest flight for free for two years. I learned travel hacking skills on blogs such as boardingarea.com and even attended Frequent Traveler University to learn tips. I learned about gift card churning, manufactured spending, mattress running, credit card bonuses, online shopping and cash back portals. With a little bit of effort, we earned hundreds of thousands of airline miles and hotel points in a very short time frame. Thus, we traveled almost every few months during those two years (with points and miles) but still spent more money that we needed to spend between eating out, resort fees, airport parking, rental cars, etc.

While I don’t regret those trips, I know that avoiding travel is best for my wallet in the short term. For this reason, my New Years’ Resolution for the past two years has been to NOT Travel. I made it decently far this year – late March – but then I got the itch and the Orlando trip happened.

We have some weddings coming up where we need to travel but besides those occasions, we are not traveling. Let’s hope I stay strong in this goal – this is a hard one for me.

Month 3 Spending Struggles

As mentioned above, it wasn’t a great month for our spending.

| Category | Spending |

| Home | $2,673 |

| Food & Dining | $1,233 |

| Travel | $774 |

| Auto & Transport | $1,494 |

| Bills & Utilities | $627 |

| Pets | $315 |

| Uncategorized | $257 |

| Health & Fitness | $158 |

| Education (Loans) | $369 |

| Gifts & Donations | $75 |

| Total | $7,974 |

On the Bright Side – Our Income is Increasing

My annual raise kicked in April 15th which was nice. I also received a verbal job offer for an internal promotion! This promotion would mean greater responsibility, more money, and the possibility to relocate to an area with a lower cost of living. I took a lesson from Sheryl Sandberg and am now waiting to hear back tomorrow on my negotiated offer. Don’t be afraid to #Ask4More, Ladies!